At the ripe old age of 50, consoles in 2022 are well positioned to gain more viewing time, albeit from a modest projected 5% share of 2022’s total.ĭespite TV’s imminent fall from its historic dominance, its ebbing share of video viewing is hardly a death knell. 15Īs for games consoles, long a mainstream feature in UK homes, they will likely compete more strongly for attention in the medium term as the base of console gamers grows and gaming becomes increasingly continuous and less occasional. The rate of growth among social media companies is impressive: Video-centric TikTok reached 1 billion monthly average users faster than any other social media company. Growing its percentage of all screen time will require making inroads among older viewers, whose total annual video consumption is multiples of that of younger people: 42.3 billion hours among age 55+ viewers in 2019, compared to 9.5 billion for 4–15-year-olds and 20.1 billion for 16–34-year-olds. It thrives on smaller screens and among younger viewers. 14įor its part, social media has long held a sizable share of screen time among UK consumers, with more than 10% every year since 2017 and a forecast 13% share in 2022. 13 About 15% of VOD subscribers in the United Kingdom are likely to cancel at least one service in 2022, even if they resubscribe within a few months. 12 But while VOD is likely to be the biggest gainer, we expect competition within the space to ratchet up, with churn being a consequence. Most of this growth has historically been in SVOD in 2022 and beyond, we expect AVOD to increase its share as new services are launched and existing services to gain momentum. The leading competitor over the past five years has been VOD, whose share in the United Kingdom we forecast to rise from 7% in 2017 to 27% in 2022, and again to 31% in 2023. 11 (For context, three decades ago, traditional TV’s primary screen-based competitor in the home was the videocassette recorder, a technology that readers under 30 may not recognize.) This trend is comparable to that in other global markets with a similar market model. Today, television broadcasters’ competition comes predominantly from the combination of SVOD/AVOD, social media, and games consoles.

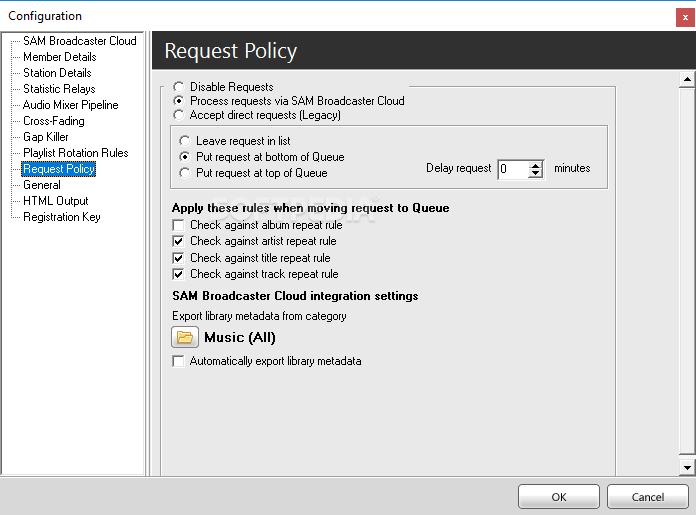

#Sam broadcaster 2016 registration key tv#

The absence of broadcaster content from the viewing diet of the under-34 age group is likely to have wide ramifications for the efficacy of advertising, with younger viewers becoming increasingly hard to reach.Ĭompetition will likely be feisty as TV broadcasters fight to regain lost ground while other media platforms jockey for position. 10 In the United Kingdom, we expect social media to dominate among younger age groups (under 34) and broadcaster content among the remainder, with SVOD/ advertising-funded VOD (AVOD) the second or third choice across all age groups (figure 2). 9Įxtrapolating five years out to 2027, video consumption patterns will likely become even more stratified by age. Children between ages 2 and 11 watched 9% of the country’s games console video content in that quarter, while 12–17-year-olds watched 18%. Among the age 18+ group, 3.7% of all video viewed in Q3 2020 was on games consoles, but viewership was tilted heavily toward youth. Stratification by age is also evident in the US market. 7 SVOD captured 29%, social media 23%, and games consoles 10% for this demographic, versus 19%, 12%, and 4% overall.

6Ĭonversely, SVOD, social media (that was not watched on a TV), and games consoles had a much higher share of viewing among 16–34-year-olds.

5 Conversely, subscription-based video on demand (SVOD) share among this age group rose from 11% to 29% over the same time period.

Among 16–34-year-olds, broadcaster content had made up 49% of viewing as recently as 2017: over three years, that share fell 17 percentage points. In the United Kingdom, broadcaster content made up 61% of all viewing in 2020 overall, but among 16–34-year-olds, that figure was just over half that, at 32%, 4 and among 16–24-year-olds, it was 26%. One element of these business models should be segmentation by age, as video viewership shows significant age-based variations that appear to be deepening over time.

0 kommentar(er)

0 kommentar(er)